boulder co sales tax 2020

The Colorado sales tax rate is currently. Through July 2020 and is largely attributed to economic activity through the month of June 2020.

733 Lakeshore Dr Boulder Co 80302 4 Beds 2 5 Baths House Inspiration Home Bouldering

You can print a 9 sales tax table here.

. For tax rates in other cities see Colorado sales taxes by city and county. Bond Sale Date. Current City of Boulder use.

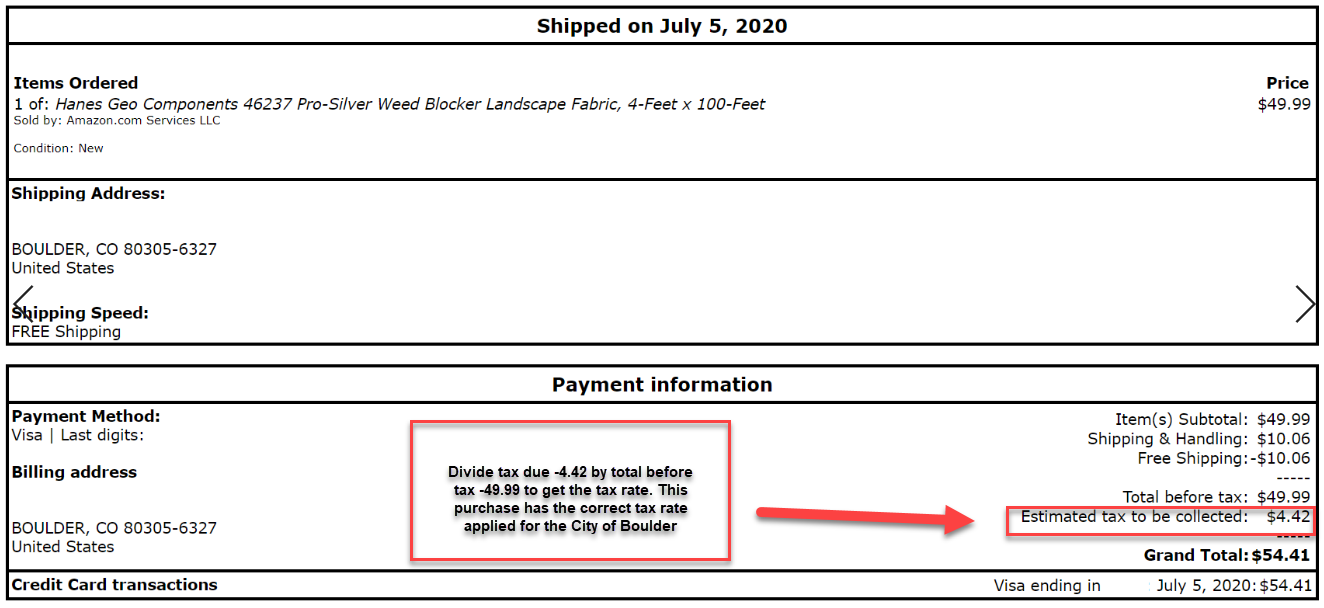

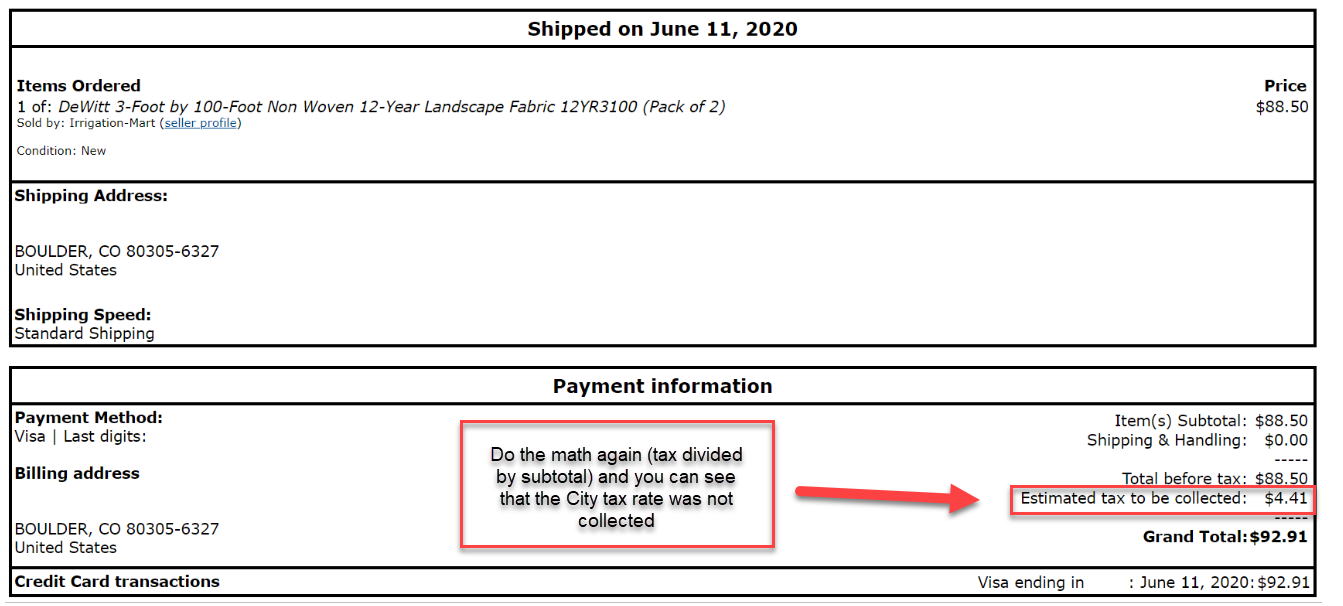

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. This is the total of state county and city sales tax rates. Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

Return the completed form in person 8-5 M-F or by mail. Boulder County CO Sales Tax Rate. BOULDER COUNTY USE TAX.

Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. The Boulder Sales Tax is collected by the merchant on all qualifying sales. This ordinance was developed by home rule municipal tax professionals in conjunction with the business community and the Colorado Department of Revenue as part of a sales tax simplification effort.

There is no applicable city tax. Effective October 1 2021 the City of Boulder adopted Ordinance No 8457 establishing an economic nexus standard for remote sellers. CBS4 Beginning Wednesday all vaping products sold in Boulder will be subject to an additional city sales and use tax of 40.

On a rolling 12-Month basis total sales and use tax based upon current economic activity declined by -545. Has impacted many state nexus laws and sales tax collection. The current total local sales tax rate in Boulder CO is 4985.

The December 2020 total local. The Boulder sales tax rate is. The minimum combined 2022 sales tax rate for Boulder Colorado is.

The city also completes tax compliance audits which may result in revenue. Month-Over-Month Change in Retail Taxable Sales. The 80303 boulder colorado general sales tax rate is 8845.

How to Apply for a Sales and Use Tax License. The minimum combined 2022 sales tax rate for Boulder County Colorado is 499. The 9 sales tax rate in Boulder Creek consists of 6 California state sales tax 025 Santa Cruz County sales tax and 275 Special tax.

Month of December 2020. The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. You can print a 8845 sales tax table here.

Including audit revenue total sales and use tax increased from 2020 by 1657565 or 1829. Boulder County Niwot Lid. The 2018 United States Supreme Court decision in South Dakota v.

Its part of an effort to curb use among young. 2055 lower than the maximum sales tax in CO. This is the total of state and county sales tax rates.

201 City retention of property tax funds Passed 6499 to 3501 Issue No. The December 2020 total local sales tax rate was 8845. Sales and Use Tax Year to date YTD sales and use tax based upon current economic activity decreased from 2019 by 6069394 or 435.

The Boulder County sales tax rate is 099. This revenue relates to prior. April 2020 retail sales tax revenue was down 246 compared to April 2019 revenue including audit revenue and the additional recreational marijuana sales tax.

Taxes on Boulders ballot 2008-2020. Office of Financial Management PO. The County sales tax rate is.

Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees. The sales tax jurisdiction name is Santa Cruz County Tourism Marketing District which may refer to a local government division. Boulder CO Sales Tax Rate.

The Colorado state sales tax rate is currently 29. The current total local sales tax rate in Boulder County CO is 4985. The city of boulder will no longer mail returns after jan.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. Sales and Use Tax Year to date YTD sales and use tax based upon current economic activity decreased from 2019 by 6807019 or -1015. On a rolling 12-Month basis total sales and use tax based upon current economic activity declined by 435.

Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020. August 5 2020 51240000 Series 2020 Tax-Exempt Fixed Rate Bonds Objectives Given favorable market conditions Boulder aimed to take advantage of low interest rates to convert intermediate debt to long-term fixed reimburse itself for prior capital expenditures and remediate a portion of existing debt used to finance assets at risk of. 202 038 sales tax extension for general fund Passed 7164 to 2836 2009 2A 015 sales and use tax extension for the general fund Passed 6804 to 3196.

For 2020 Boulder County collects use tax at the rate of 0985. This is the total of state county and city sales tax rates. 2055 lower than the maximum sales tax in co.

Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Las Vegas

Innovation Technology City Of Boulder

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

Boulder Exploring New Taxes Fees As Revenues Falter Boulder Beat

Http Www Fullersothebysrealty Com Eng Sales Detail 218 L 868 Wpp6wg 1538 75th Street Boulder Co 80303 Luxury Swimming Pools Indoor Outdoor Pool Dream Pools

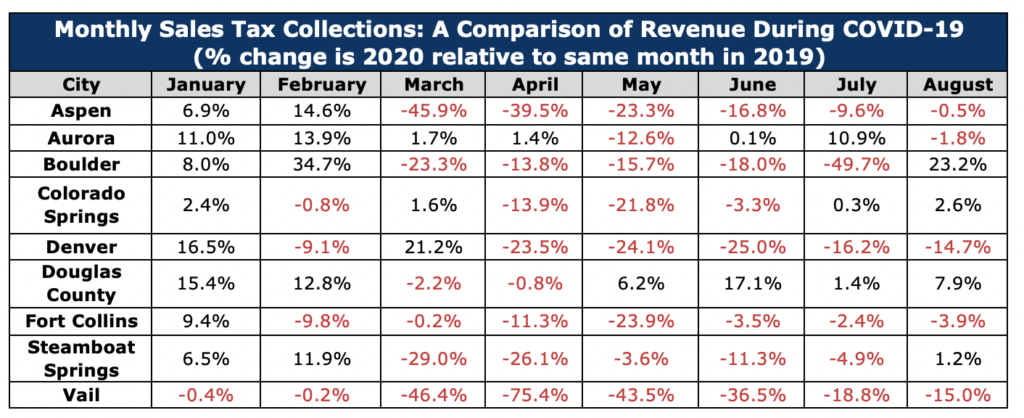

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

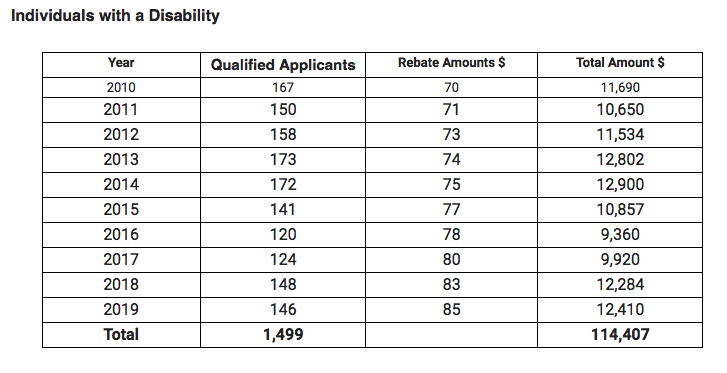

Taxes In Boulder The State Of Colorado

2515 Boulder Rd Altadena Ca 91001 Mls P1 4307 Redfin Bouldering House Styles Exterior

Cience Debuts At 31 In The Financial Times Americas Fastest Growing Companies 2020 Send2press Newswire Financial Times How To Start Conversations Financial

Construction Use Tax City Of Boulder

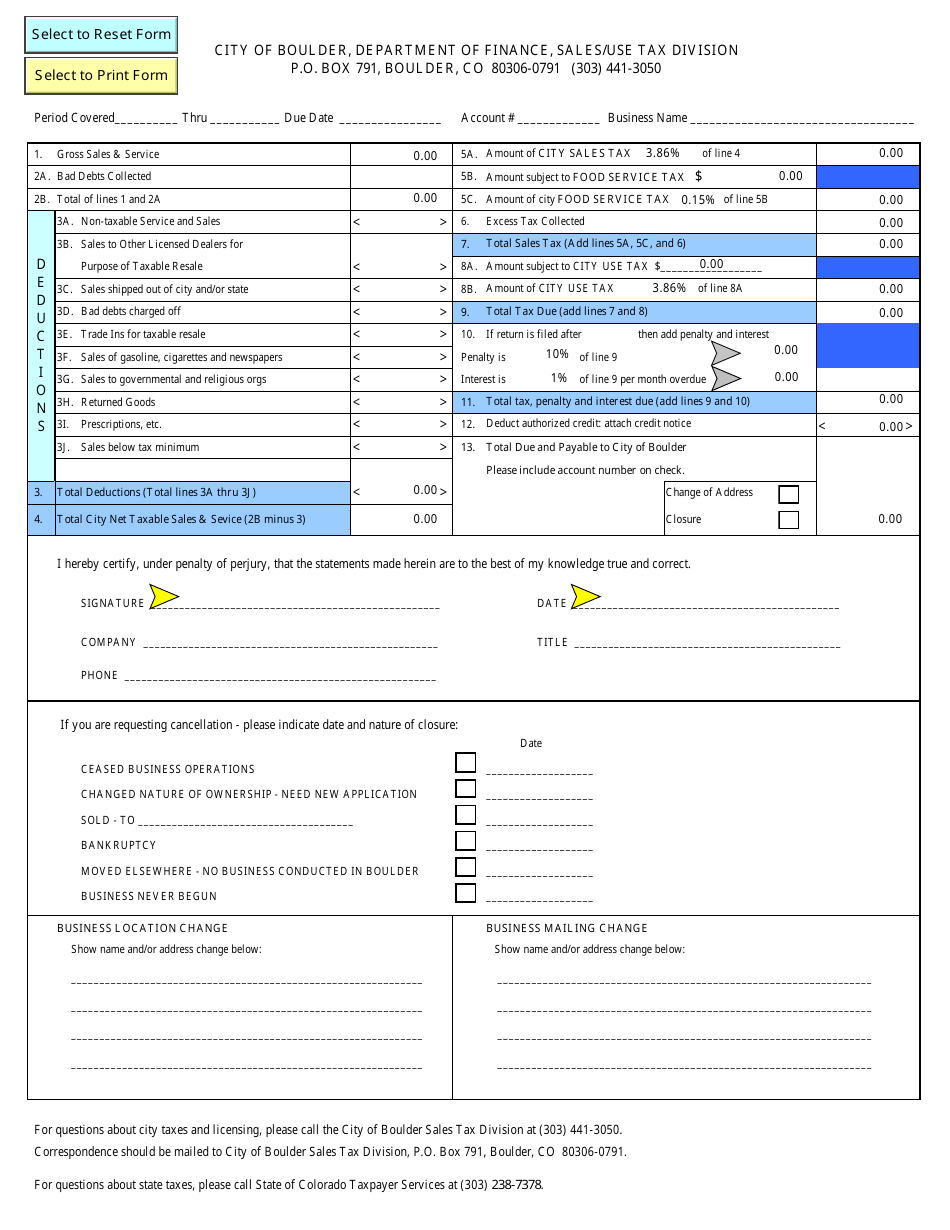

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Should Boulder Do Away With Sales Tax On Groceries Boulder Beat

1 Thayer Rd Santa Cruz Ca 95060 5 Beds 5 Baths Santa Cruz Scotts Valley State Parks

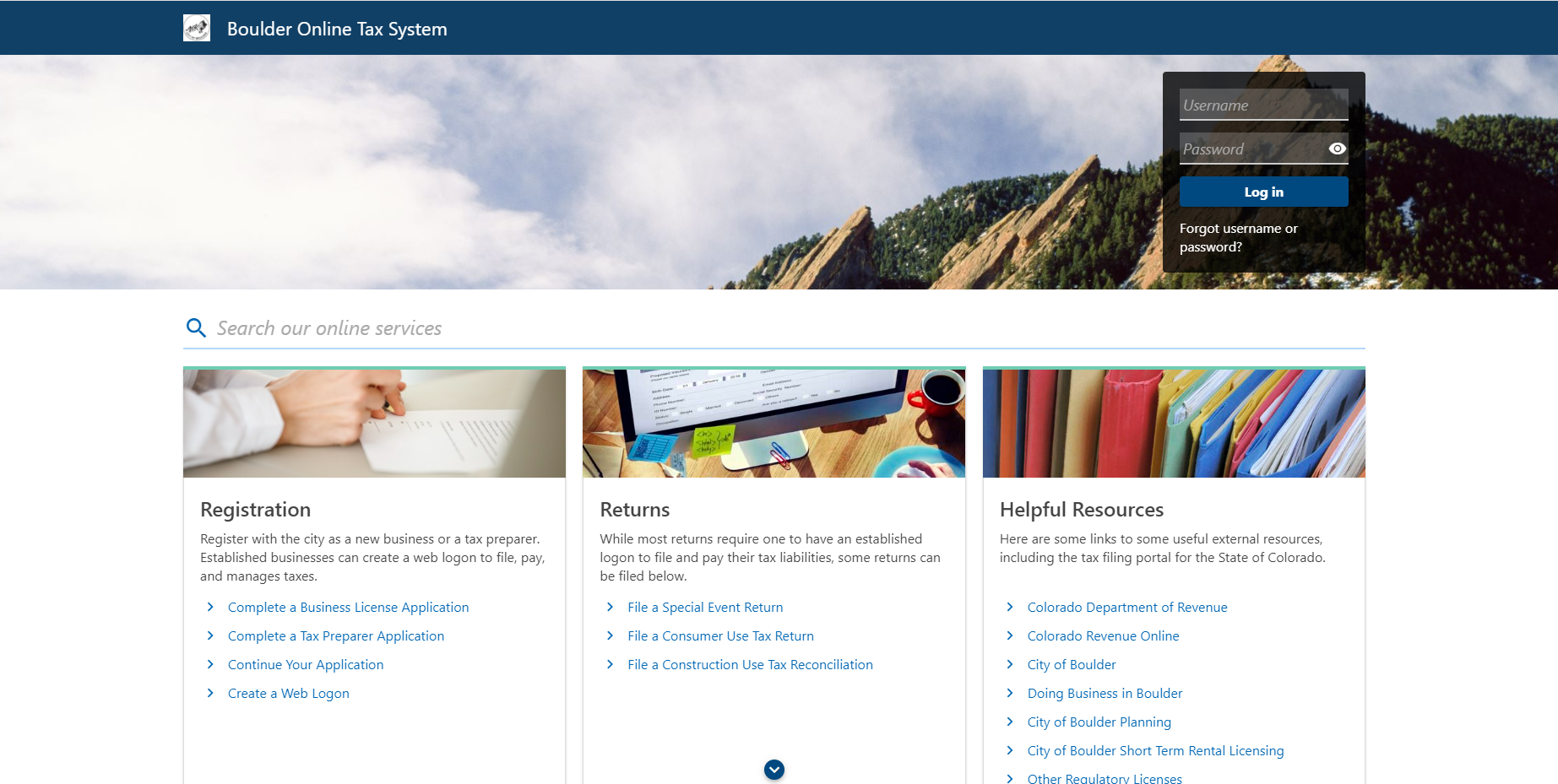

Sales And Use Tax City Of Boulder

10402 Manly Chapel Hill Nc 27517 Photo 7 Of 29 Chapel Hill House Design Chapel